I Eat Fast Food

Purely as part of my academic research, I have been eating a lot more fast food, checking out limited time only offers and the restaurants’ service.

For breakfast the other day, I ordered fried egg and burger sliders with caramelized onions and no cheese at White Castle. The receipt was correct, but the order had cheese. At McDonalds, I ordered a Sweet Chili Chicken wrap but received a Ranch Chicken Wrap. The receipt was correct, but it took 20 minutes to place and receive my order at a store that was well staffed with only a few in-store customers — apparently employees were focused on the busy drive-thru. Order complexity, wait times, speed, and accuracy are among the many issues the restaurant industry faces.

The whole topic of in-store engagement and alternative payment systems is heating up. Let’s face it — nearly everyone who visits quick serve restaurants has a mobile device on them. These restaurants (and grocery stores) have similar high traffic and low margins and both seek customer loyalty. Of the two, only grocery stores have succeeded with loyalty programs. There is hope that personalized, socialized, and mobile technology will change the game for quick serve restaurants and prove to be a winning tactic.

Fast Food Forced Errors

Online ordering and payment reduce errors, increase transaction speed, and narrow casts notifications (an easy way to tell you an order is ready). Labor-saving efforts normally require consumer and staff education that increases when the change is complex. Apps facilitate labor reduction and eliminate many education requirements while cloaking complexity with a well-mannered user interface. Companies like McDonalds, Burger King, and Subway are investigating these technologies; at Five Guys, consumers can order from the counter, a website, or mobile app.

Mobile payments and ordering will benefit chain owners, but I am rather sure this offers few benefits to the consumer. Mobile ordering is not going to solve the problem of correctly entered orders served incorrectly. Then there is the willingness and time needed to set up a wallet. Up to three times more millennials are embracing mobile payment over Gen X and Boomers, according to at least one report. Will merchants accept universal payment systems? It might be cheaper if each chain has its own payment system. Private wallets lock-in customers, in the same way JC Penny won’t accept a Macy’s charge card.

Waiting

If I am waiting in a line, I’m holding my phone. If I had a e-wallet on my phone, I would rather use it than put away my phone, find my actual wallet, and fish out my debit card or cash. Not having to put away a phone and then find a physical wallet might be the only consumer benefit. But will consumers embrace mobile wallets? Seventy percent of GenY have not done this yet. Long term, consumer benefits (beyond speed and convenience) might include the ability for parents to pre-approve spending for particular items at particular times and locations, or constrain personal or family member spending to pre-set budgets.

For the restaurants themselves, payment from an application or mobile device opens the door to a more direct and intimate relationship with customers, potentially driving loyalty and retention. If McDonalds, Wendy’s, Five Guys, Subway, and other chains start accepting universal wallets, that could drive setup and create an ecosystem for the benefit of other merchants. Quick-serve restaurants will benefit — if the trend mirrors credit cards — as consumers buy more often, buy larger quantities, or buy more profitable items. Businesses will also benefit if transaction fees are lower, as higher fees would be counter productive. Let’s assume they don’t have to give Google, Amazon, Apple, Sprint, AT&T, or Verizon a cut of the transaction.

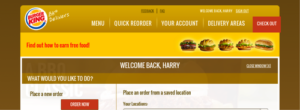

With few intrinsic benefits, perhaps merchants will offer discounts and free food as an enticement. Burger King’s online delivery system attempts to do this by building a loyalty program into the online ordering process.The loyalty program and the relationship that comes with it may well be worth the price of admission for merchants and consumers. If restaurants must offer discounts and free food to jumpstart mobile and online ordering, let’s hope it pays off for both parties.

Consumer Choice

Consumers won’t voluntarily embrace something that gives them little or no benefit. How much free food and coupons will habituate consumers to this new experience? Chipotle is adding games. Is that an incentive or a distraction? Only time will tell.